BARU GOLD CLOSES SHARES FOR DEBT SETTLEMENT

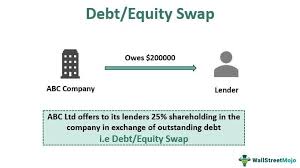

Baru Gold Corp. has approved the settlement of up to $162,782 of debt through the issuance of common shares of the company. Pursuant to the debt settlement, the company would issue up to 10,852,133 common shares of the company at a deemed price of 1.5 cents per share to Shidan Murphy, director of the company.

The debt settlement, previously announced on Aug. 29, 2024, has been amended to $162,782 cash advances to the company from November, 2022, to May, 2023. These cash advances were non-interest bearing, unsecured, with no stated terms of repayment.

The issuance of the common shares to the creditor is subject to the final acceptance of the TSX Venture Exchange. All securities issued will be subject to a four-month hold period which will expire on the date that is four months and one day from the date of issue.

The creditor participating in this debt settlement is an insider of the company and, accordingly, the debt settlement and the cash advances to the company are considered a related-party transaction as defined under Multilateral Instrument 61-101 (Protection of Minority Security Holders in Special Transactions). The company relied on the exemptions for a formal valuation and minority shareholder approval requirements under MI 61-101 on the basis of the exemptions of MI 61-101, as neither the fair market value of the shares issued to insiders in connection with the debt settlement and the fair market value of the advances did not exceed 25 per cent of the company’s market capitalization.

About Baru Gold Corp.

Baru Gold is a dynamic junior gold developer with NI 43-101 gold resources in Indonesia, one of the top 10 gold-producing countries in the world. Based in Indonesia and North America, Baru’s team boasts extensive experience in starting and operating small-scale gold assets.