Looking at the 2023 forecast of the largest anticipated recession ever in humankind history, it’s hard not to feel optimistic about gold prices.

Obviously besides hoarding gold bars in a safe and buying ETF like $GLD, how would one get exposure to gold miners?

The largest mines on NYSE, NASDAQ come to mind. first let’s start off larger then move our discussion to smaller names.

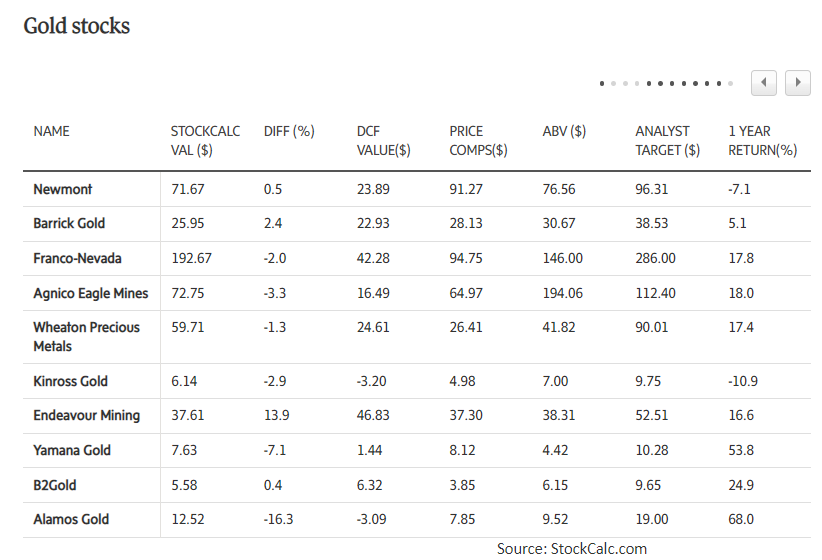

StockCalc.com provided chart below of analyst concensus for 2023 on below $NEM, $AGX, $FNX, $AEM $KGC $EDV $AUY, $BTO and Alamos of the world and respective returns.

For fresh capital going in – hard to bet against Clive and team. FNX (Royalty) model we know works well, no reason why it should change.

Then lastly Agnico (even though not silver anymore) still well run.